Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you complete the stated prep course(s) or possess the equivalent knowledge prior to enrolling in this course:Mergers and Acquisitions (M&A) Modeling Course

Welcome to CFI’s advanced financial modeling course on mergers and acquisitions (M&A). This course is designed for professionals working in investment banking, corporate development, private equity, and other areas of corporate finance that deal with analyzing M&A transactions.M&A Modeling Course Objectives

This advanced financial modeling course has several objectives including:- Learn how to structure an M&A model in the most efficient way

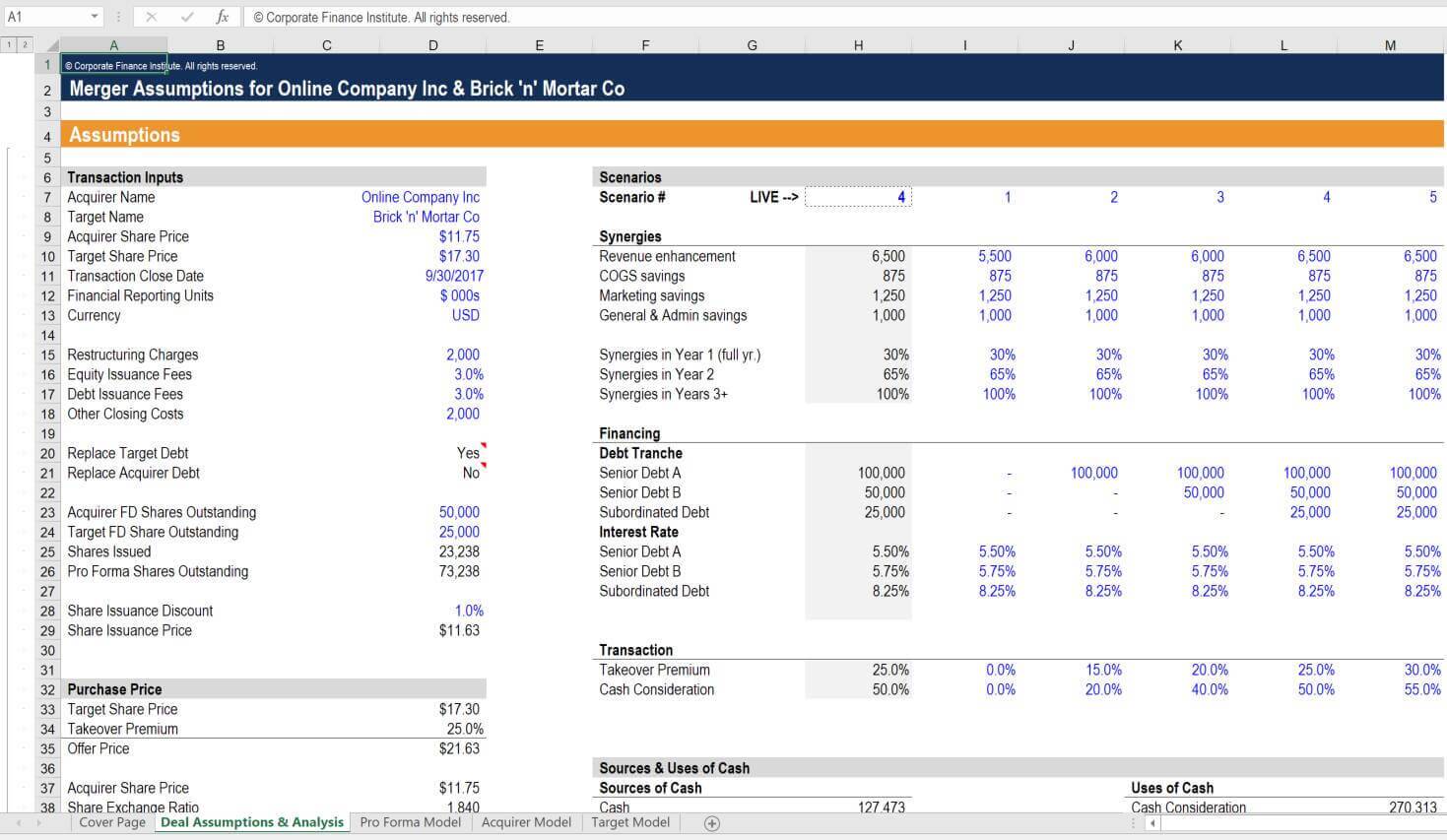

- Set up all the assumptions and drivers required to build out the M&A model

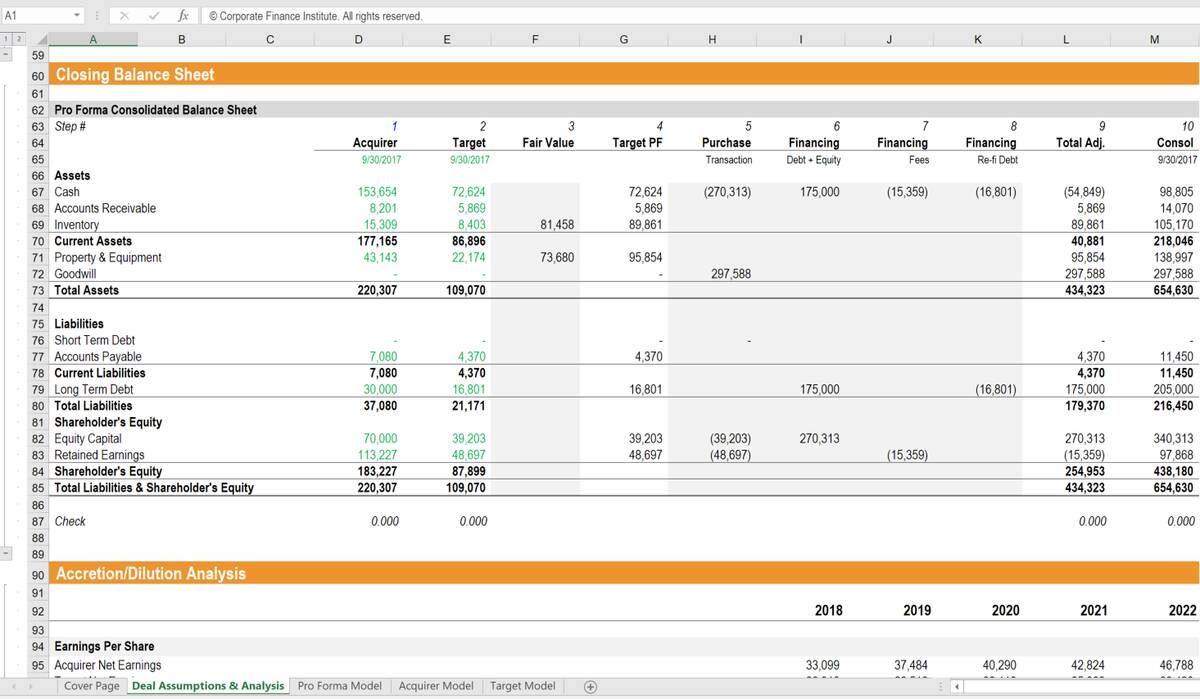

- Calculate all the necessary adjusting entries required to create a post-transaction balance sheet

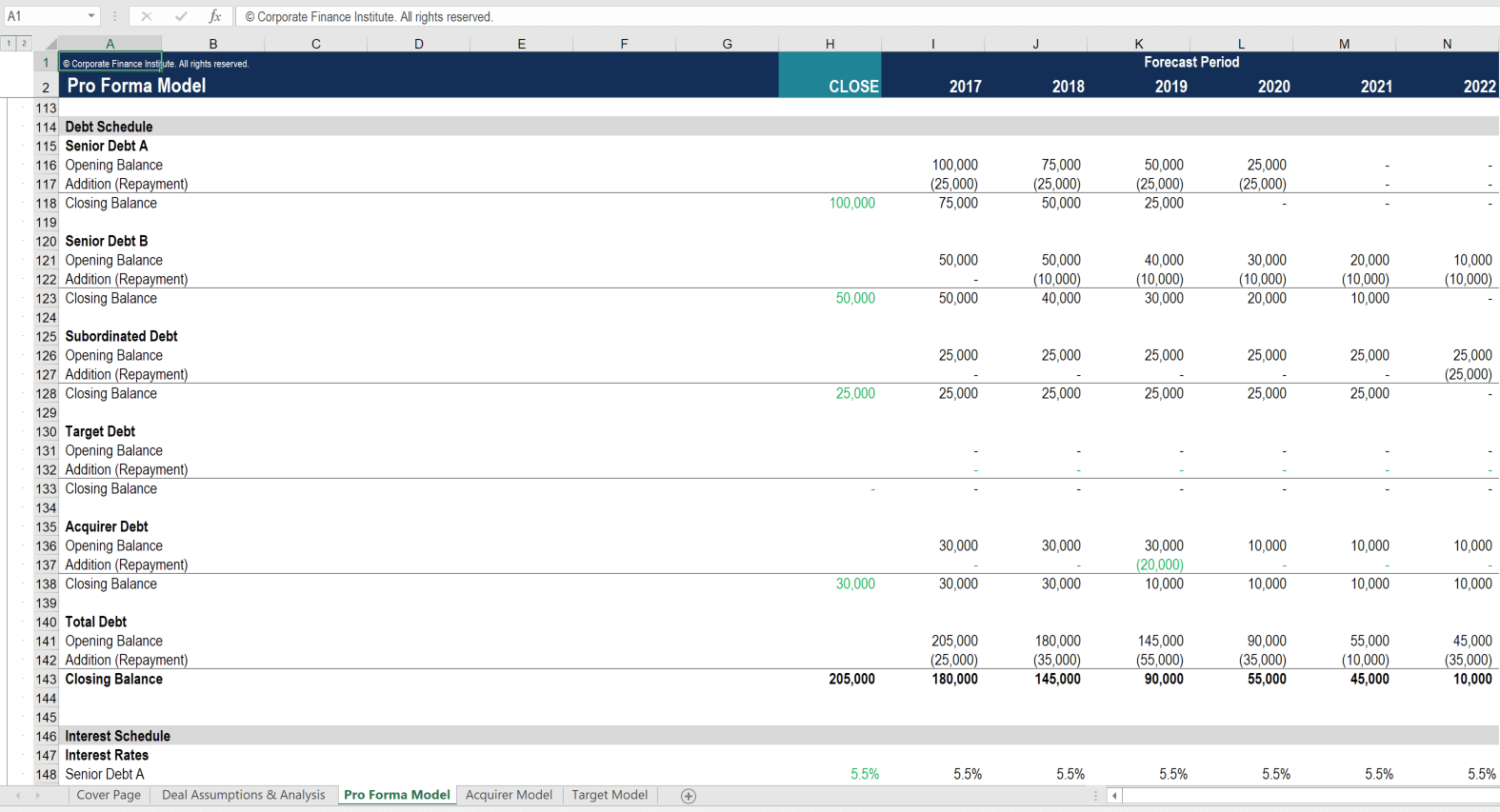

- Integrate the acquirer and the target into a pro forma model

- Calculate the accretion or dilution of key per-share metrics post-transaction

- Perform sensitivity analysis on key assumptions and assess the overall impact of the transaction

Who should take this course?

This class is perfect for anyone who wants to learn how to build a financial model for mergers and acquisitions from the bottom up. The video-based lessons will teach you all the formulas and functions to calculate stub periods, outline sources and uses of cash, perform a purchase price allocation and determine goodwill, create multiple scenarios for synergies and other key assumptions, and integrate all of the above into a well laid out pro forma model. In addition to learning the detailed mechanics of how to build the model, students will also learn how to assess the impact of the transaction through accretion/dilution analysis and the impact on the implied share price (intrinsic value per share). By performing sensitivity analysis, users will understand how a change in assumptions impacts future outcomes of the merger or acquisition.Mergers and Acquisitions Course Case Study

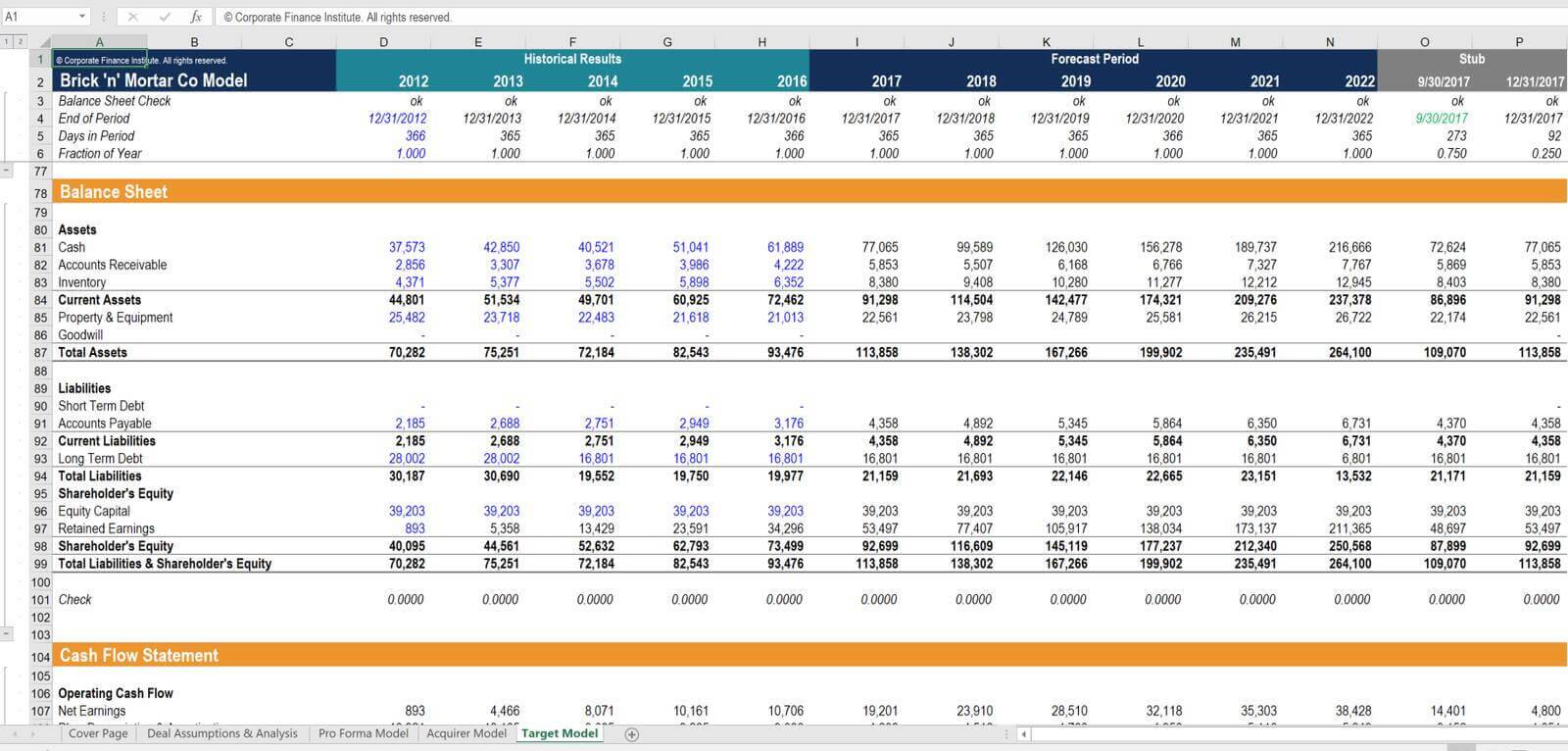

This course is built on a case study of Online Company Inc acquiring Brick ‘n’ Mortar Co. Through the course of the transaction, students will learn about:- The construction of a detailed Pro Forma model

- Analysis of synergies, revenue enhancements, cost structures

- Integration considerations

- Accretion / dilution analysis

- Deal terms and structuring

- The strategic impact of combining the businesses

- Share price impact

What’s included in this M&A course?

This mergers and acquisitions course includes all of the following:- Blank M&A model template (Excel)

- Completed M&A model template (Excel)

- 4+ hours of detailed video instruction

- Certificate of completion

Mergers & Acquisitions (M&A) Modeling

Get StartedLevel 4

Approx 8h to complete

100% online and self-paced

Get Recognized With CFI

See All Certification ProgramsWhat you'll learn

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

What our students say

A must to do for Finance students & Professionals

Puneet Kumar Bagga

I loved this course. The course presenter explained complex topics in a very easy way, loved it.

hassan raza

The course is so much fun, even thought its complex and complicated. But M&A is important to know and excel to especially for those working on financial company. I'm happy to learn more and review my excel model every time I need to learn and rewind what i've study

Arvin winatha

First time learning M&A models and it was great!