Choose from 12 optional courses to learn or review the fundamentals.

-

CBCA program: 59 total courses, 19 required for exam eligibility

-

Self-paced & 100% online

-

Get full CBCA program, community, & more with a CFI membership

-

Get this program and CFI's full training catalog for your organization

-

Manage learning, create custom paths & measure progress

-

For teams of 2 or more users

CBCA® At a Glance

CFI’s Commercial Banking & Credit Analyst (CBCA®) Certification Program propels your commercial lending career with essential skills for starting or advancing a commercial lending career. Learn advanced underwriting for more profitable deals through our purpose-built curriculum, offering 50+ banking courses, case studies, and a resource library with financial models and risk assessment tools.

This comprehensive program supports growth in roles like commercial banker, credit analyst, risk manager, or private lender, covering financial analysis, credit structuring, and qualitative skills such as management and industry analysis, effective business and credit writing, and sales and relationship management. Elevate your career as a world-class commercial lending professional with CFI's CBCA® Certification Program.

What's in the Commercial Banking & Credit Analyst Program?

59 courses

Consisting of 2710+ lessons

310+ interactive exercises

Learn by doing with guided simulations

Blockchain certificate

To verify your skills

500,000+ 5-star ratings

Best-in-class training, as rated by you

The CBCA®️ program has upskilled teams at:

Earning Your Commercial Banking & Credit Analyst Certification

Step 2: Core Courses

Complete 16 required core courses to build your skill set in .

Step 3: Elective Courses

Choose a minimum of 3 electives (out of 25 available) to master more advanced topics and specialized lending concepts.

Step 4: Case Study Challenges Optional

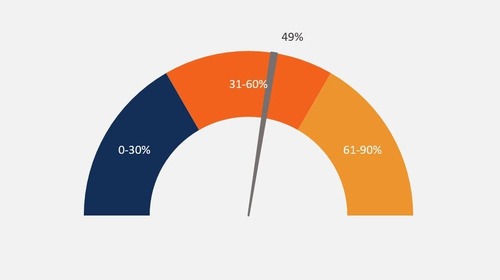

After earning a minimum passing grade of 70% in each course assessment, take a final exam in BI and data analysis to earn your program certification.

Step 5: Final Exam

After completing the required courses, take a final exam in credit and lending (with a minimum passing grade of 70%) to earn your program certification.

Step 6: Get CBCA® Certified

Congratulations! Upon completion of the program, you will receive a blockchain-verified digital certificate with your new credentials. You also have the option to order a physical certificate to be mailed to your door.

Skills & Learning Objectives in Banking & Credit Analysis

Financial Analysis

Hide Details-

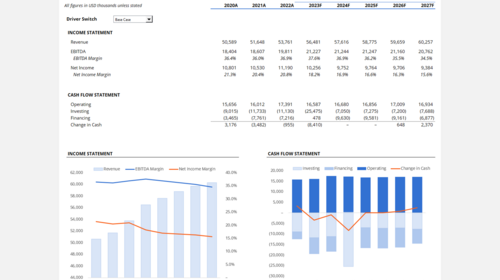

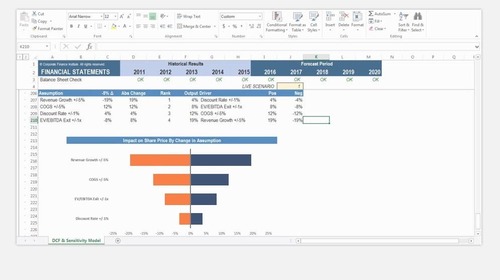

Understand and project cash flow cycles and a borrower’s working capital funding gap

-

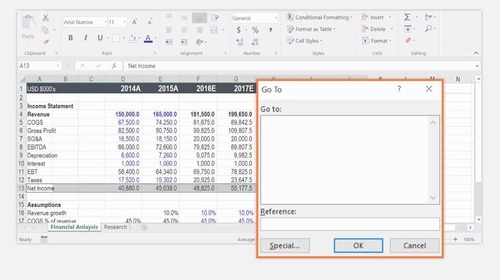

Build a dynamic, logically designed, well structured 3-statement financial model

-

Calculate a borrower risk rating based on historical financial results

Credit Structure & Documentation

See DetailsManagement & Business Analysis

See DetailsRisk Management

See DetailsIndustry Analysis

See DetailsCourses Taught by Banking & Credit Experts

Lisa Dorian

Kyle Peterdy

Tim Vipond

Scott Powell

Gabriel Lip

Careers in Commercial Banking & Credit Analysis

-

Risk Manager & Credit Adjudicator

Assess and approve transactions for banks and other financial institutions. -

Commercial Loan Broker

Analyze and package deals more effectively to facilitate quicker turnarounds and better terms for clients. -

Private Lender

Work with capital providers and family offices to underwrite more effective credit transactions, including commercial real estate financing and asset-based lending. -

Credit Analyst

Expand your knowledge and expertise to work in corporate or commercial banking, as well as rating agencies. -

Commercial Loan Officer

Work with owner-operators and C-level executives on behalf of financial institutions to manage borrowing.

What Our Students Say

The best course to have in depth knowledge of Credit analysis. I would recommend this course to all who are in process to learn credit analysis.

Abhishek Choudhry

CBCA is a very relevant certification for professionals who are or aspire to be in Commercial Banking and for people who want to have a general understanding of finance.

Vikram Singh

I found the CBCA as one of the best certificates in banking, and I recommend all Relationship Managers in SME/Corporate banking, and the credit risk assessors to take this designation.

Subhi Ghazal

All courses of the CBCA program were provided in a very clear and easily understandable way. The lecturers were covering the subjects in a very effective manner. The design of the presentations looks very pleasant too.