Learn Valuation with CFI

Topic Overview

15 courses

Consisting of over 840+ lessons

90+ interactive exercises

Learn by doing with guided simulations

Expert instructors

Learn from the very best

New courses monthly

On need-to-know subject matter

Blockchain certificate

To verify your skills

500,000+ 5 star ratings

Best-in-class training, as rated by you

Find the right Valuation course

Top Valuation Courses

Browse all coursesWhy Learn Valuation with CFI?

As one of the leading providers in online finance certification programs, CFI helps current and aspiring finance professionals reach their career goals. All of our courses are designed by professional trainers with decades of experience training valuation at global financial institutions.

We offer comprehensive finance education that combines theory with application to build real-world skills for a future in finance. All programs are online and self-paced, so you can learn in your free time and develop your skill set anytime, from anywhere.

Who should take these courses?

Investment professionals

Management consultants

Financial analysts

Registered Provider: National Association of State Boards of Accountancy

All courses are accredited by the Better Business Bureau (BBB), CPA Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA) in the US. Most courses qualify for verified CPE credits for CPA charterholders.

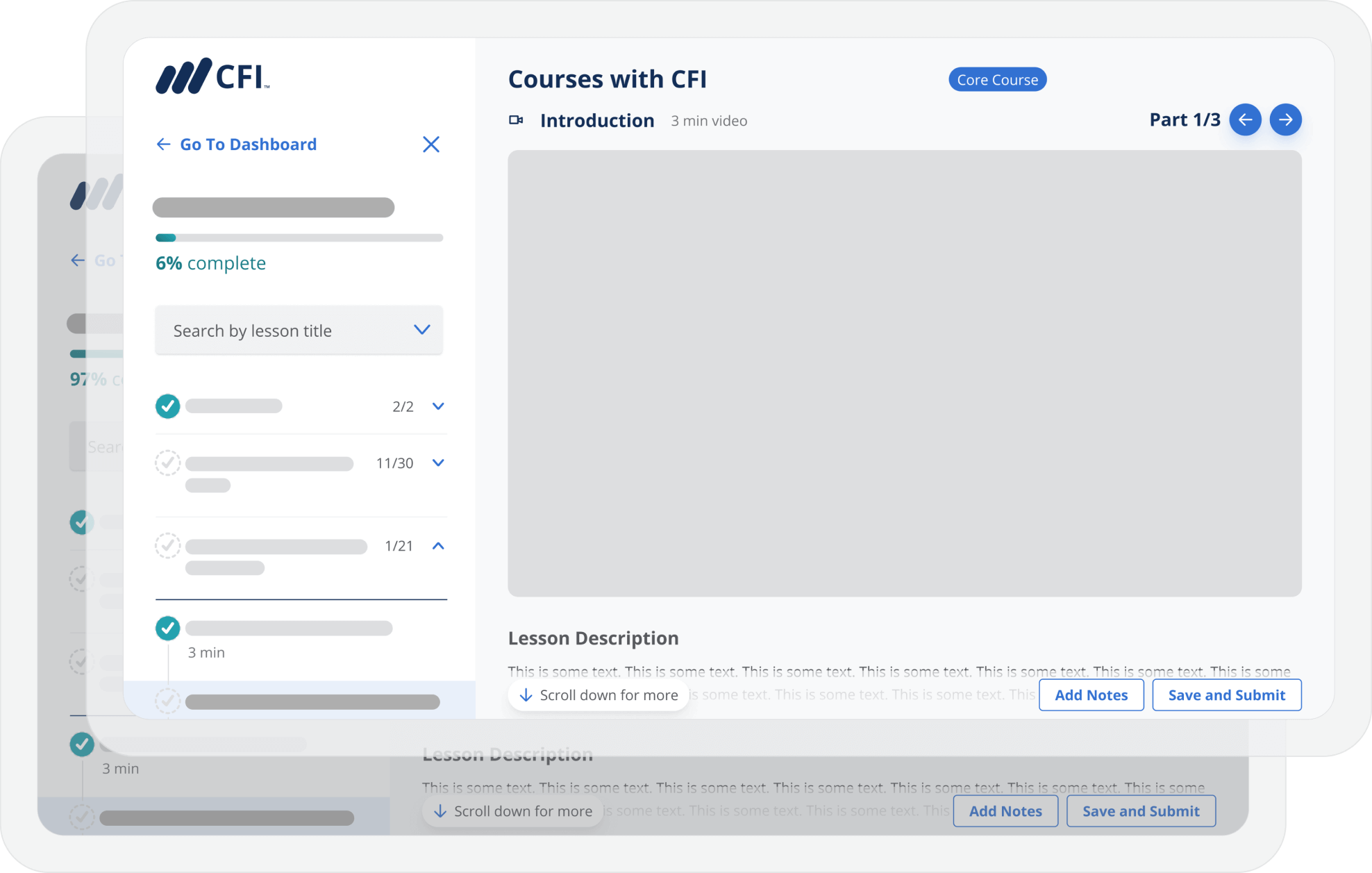

Courses include video lessons, templates, quizzes, and final assessments.