Overview

Cash Flow Cycles and Analysis Course Overview

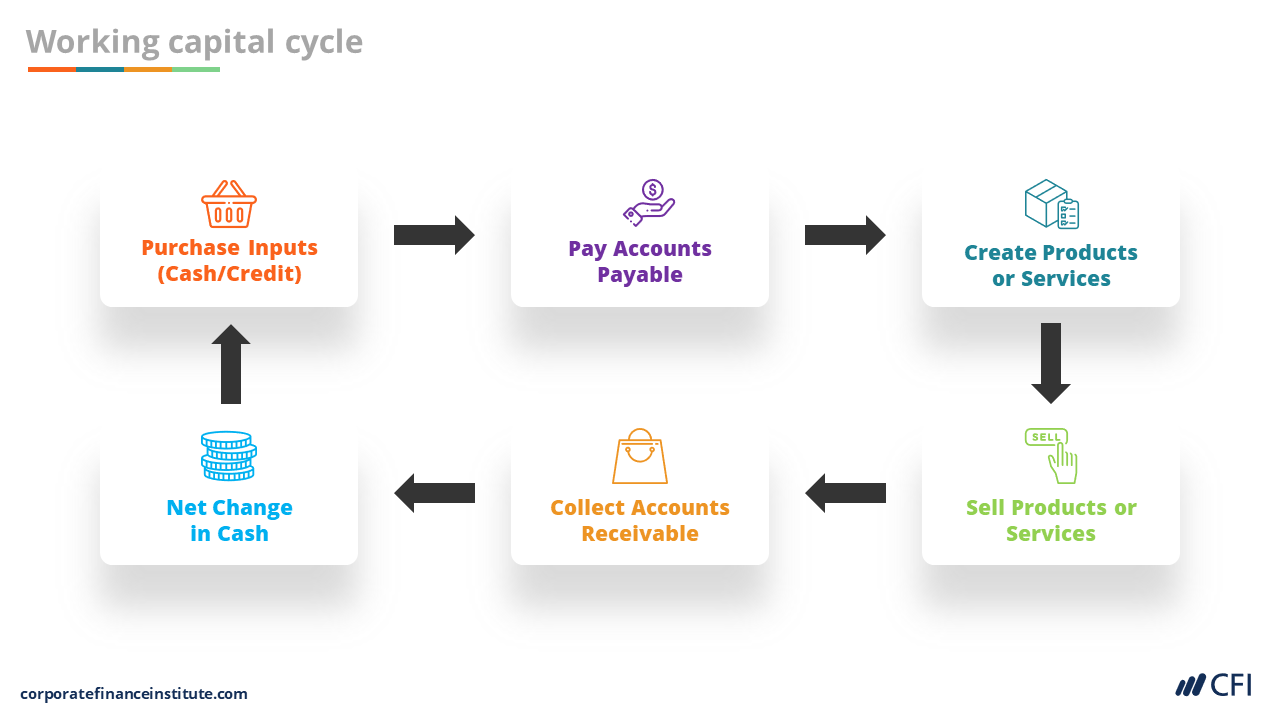

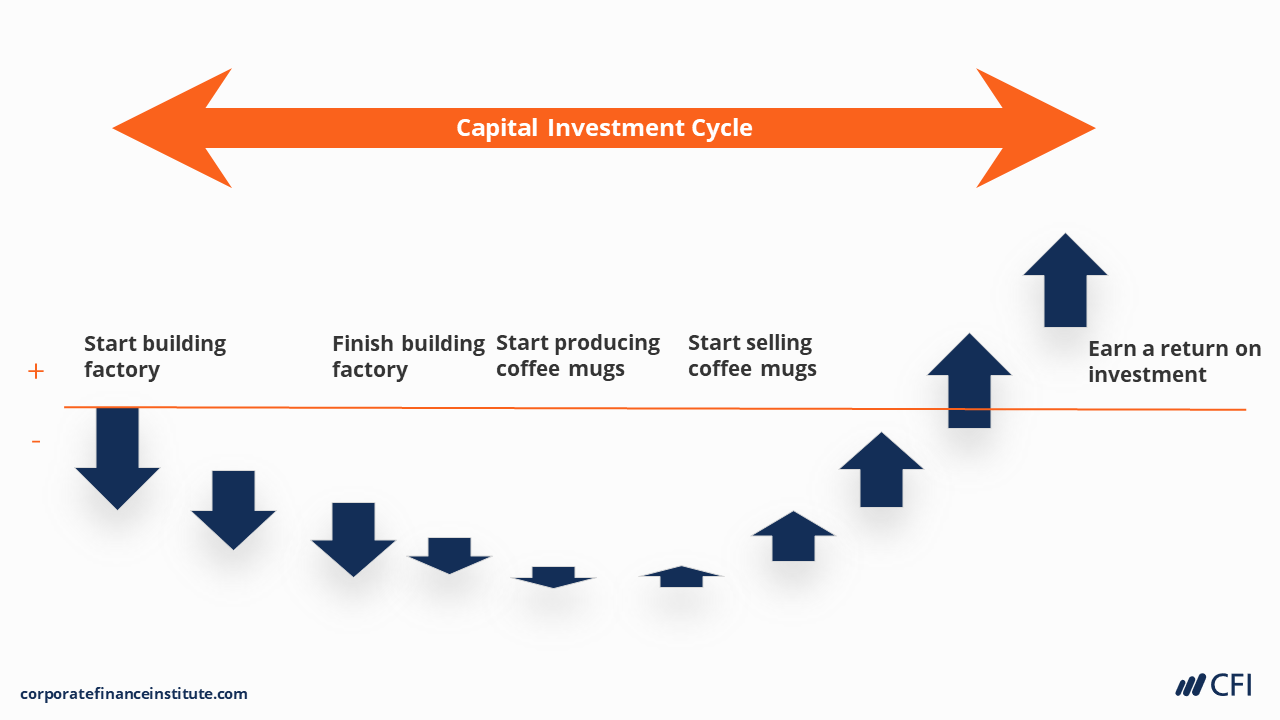

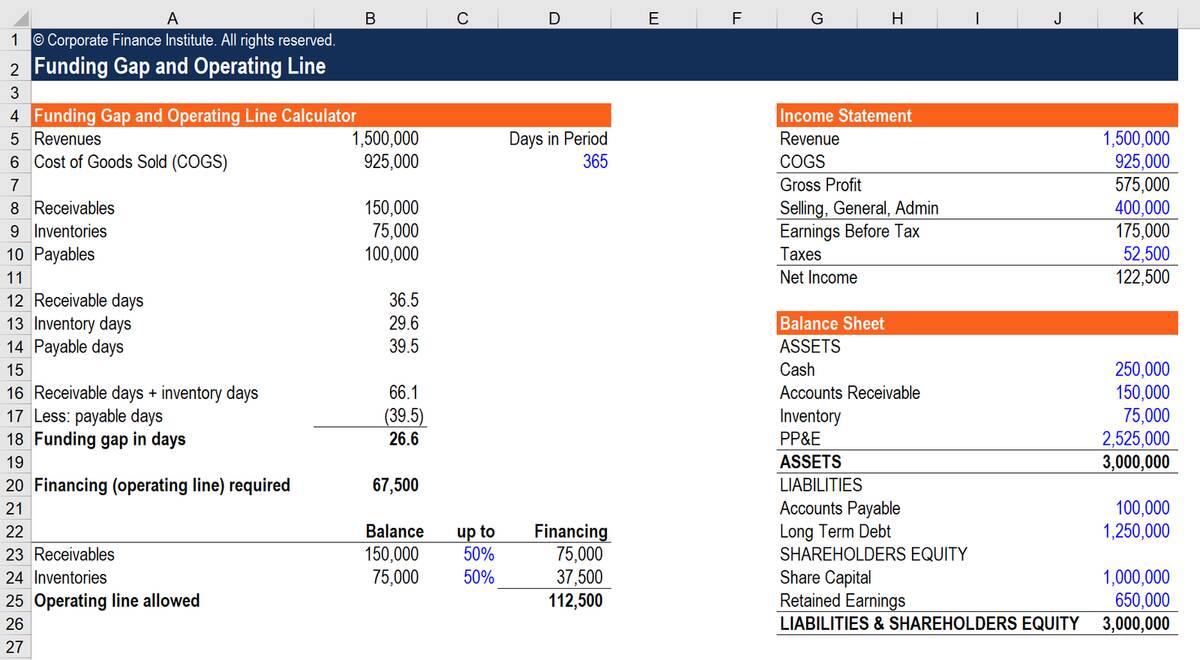

In this Cash Flow Cycles and Analysis course, we look at how companies manage their cash flow. We will explore both the operating cash flow cycle and the investing cash flow cycle. We use real-world examples to calculate a company’s working capital funding gap. Then we will go over important strategies companies can use to optimize their working capital accounts.Cash Flow Cycles and Analysis Learning Objectives

Upon completing this course, you will be able to:- Discuss the difference between a company’s short-term operating cash flow and long-term investing cash flow

- Compare working capital objectives and capital investment objectives

- Calculate working capital funding gap, investment payback and return on investment

- Use a company’s financial statement to conduct a cash flow analysis and compare key metrics

Who should take this course?

This Cash Flow Cycles and Analysis course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.Cash Flow Cycles and Analysis

Get StartedLevel 3

Approx 2.5h to complete

100% online and self-paced

Get Recognized With CFI

See All Certification ProgramsWhat you'll learn

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

What our students say

Great learning resources! Simple and straight to the point without compromising high standard.

Isaac Audu Agbor

This course is really helping me on how to analyze cash flow cycles for a company

Arvin winatha

I really loved this course and way of lecturing

Kassahun Kumalo

Clear and concise way of demonstrating WC