Factor Analysis

A statistical technique designed to draw out the substance of complex data

A Comprehensive Guide to Factor Analysis

Factor Analysis is a powerful statistical method used in a wide range of fields. In this article, we will take a closer look at factor analysis, with a focus on its role in finance. We’ll explain its key concepts, show how it’s used in real-life applications, and discuss the different types of factor analysis.

We will also provide a comparison of the advantages and disadvantages inherent in this analytical technique.

What is Factor Analysis?

Factor analysis is a sophisticated statistical technique designed to draw out the substance of complex data by identifying observable variables and all of the underlying factors that account for the observed correlations among multiple variables.

Observable variables, sometimes referred to as “indicators,” are the measurable variables that are collected in the statistical analyses. Unobserved factors, or just factors, on the other hand, are the unobserved variables or constructs that underlie observed variables.

By determining the common threads that interconnect a set of variables, factor analysis helps to explain the complexities of data, including the identification of the number of factors, offering a solution to researchers and analysts who perform factor analysis.

Fundamentally, factor analysis seeks to pare down the extensive universe of variables while preserving the intricate relationships within all the variables and data.

How Factor Analysis is Used

Factor analysis is incredibly useful in research with a wide range of applications. It can be used in a lot of different tasks:

- Dimension Reduction: When you have big sets of data, with lots of variables and potentially a large number of factors, factor analysis is useful in making the data set simpler and helping in data reduction. It does this by grouping similar things together, making the analysis easier.

- Data Interpretation: Factor analysis acts as a deciphering tool, uncovering hidden patterns and structures within data sets that might not be evident in any initial direct observation. This insight is pivotal in revealing hidden relationships between observable variables.

- Variable Selection: Factor analysis enables researchers to cherry-pick the most relevant variables from all the variables within a data set. This means that redundant or highly correlated variables can be removed or grouped together.

- Construct Identification: By focusing on things within the data we cannot directly see or the unobservable variables, factor analysis shines a light on the hidden parts of the data, making it easier to understand and accentuating the underlying constructs of the data.

- Hypothesis Testing: Researchers use factor analysis to put hypotheses to the test, refine their models, and get a clear picture of how variables interact with each other.

The Influence on Finance

To highlight the relevance of factor analysis in the field of finance, here are some practical scenarios:

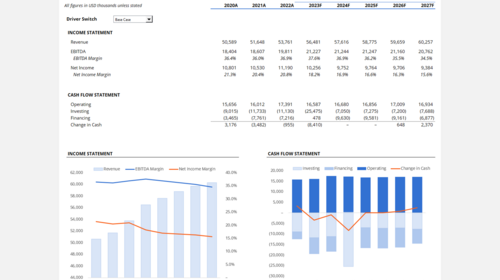

1. Portfolio Management

In the field of finance, factor analysis serves as a cornerstone of modern portfolio theory. Factors represent economic variables or market trends, or underlying variables such as interest rates, inflation, or industry-specific dynamics.

By exploring historical data, portfolio managers can evaluate the impact of various factors on asset returns and portfolio risk. This insight informs decisions related to portfolio allocation and risk management.

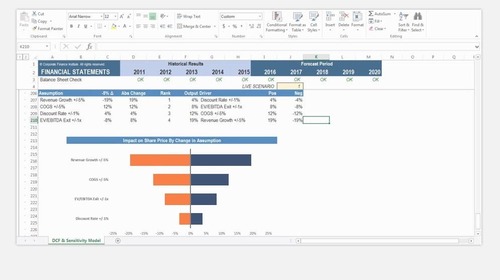

2. Asset Pricing Models

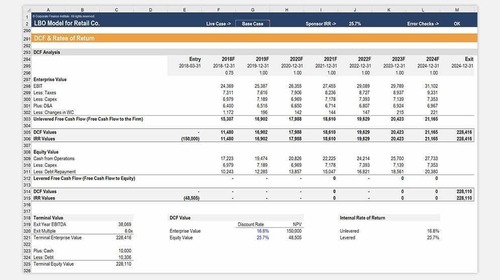

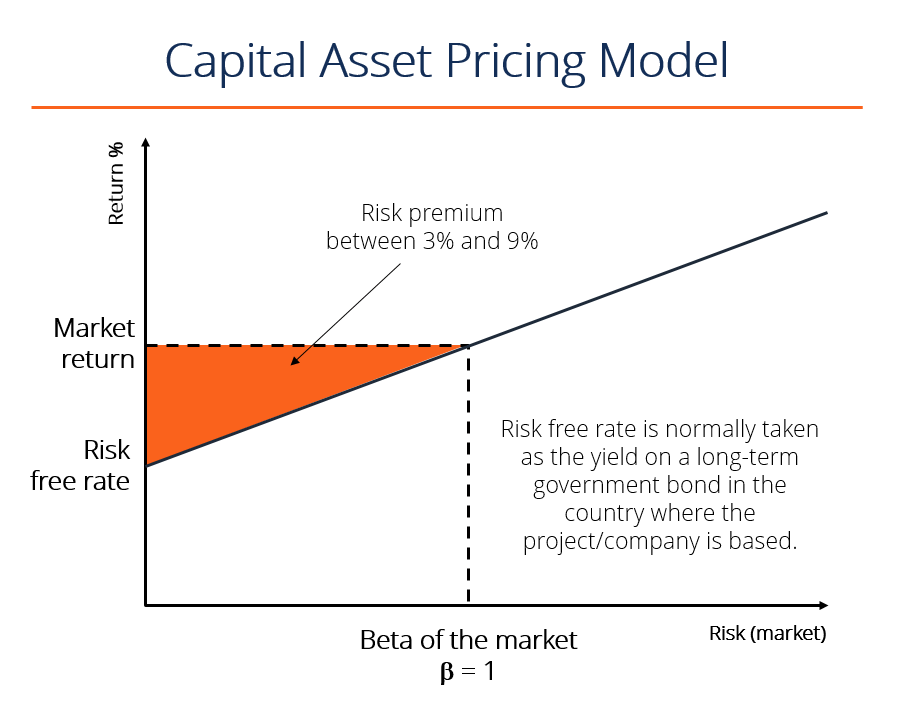

Models like the Capital Asset Pricing Model (CAPM) and the Fama-French Three-Factor Model lean heavily on factor analysis. These models employ factors such as market returns, size, value, and momentum to help determine the expected returns of assets.

Researchers employ factor analysis to gauge the significance of factor loadings and estimate their values, with common factor analysis forming the bedrock for asset pricing and risk assessment.

3. Credit Risk Analysis

Factor analysis assumes a pivotal role in the realm of credit risk assessment. Lenders employ this methodology to appraise the creditworthiness of borrowers.

By scrutinizing an array of financial and non-financial factors, the factor analysis model dissects the pivotal variables contributing to credit risk, enabling lenders to make more judicious lending decisions.

Types of Factor Analysis

Factor analysis is not a one-size-fits-all methodology. It comes in a spectrum of approaches, each tailored to specific research objectives:

Exploratory Factor Analysis

Exploratory Factor Analysis is a data-driven approach that attempts to identify the underlying structure or patterns in a set of observed variables. It is a method for reducing the dimensionality of data by grouping related variables together into common factors.

Exploratory Factor Analysis is often used to uncover latent factors and unobservable variables that influence observed variables. It’s important to note that because of its nature, Exploratory Factor Analysis is just that: exploratory in nature, and its findings may be preliminary, requiring further confirmation analyses to validate the identified factor structure.

Confirmatory Factor Analysis

Unlike Exploratory Factor Analysis, Confirmatory Factor Analysis is theory-driven and suited for scenarios where researchers possess a preconceived theoretical model.

Confirmatory Factor Analysis scrutinizes data to determine whether it aligns with the predefined model, offering validation and insights into the model’s goodness of fit. It is a valuable tool for hypothesis testing and model validation.

Principal Component Analysis

While not a true factor analysis technique, Principal Component Analysis is often helpful for simplifying data by reducing its dimensions. Reducing dimensions means simplifying complex data by capturing essential information with fewer factors while eliminating less important details.

This involves creating new variables, or principal components, which are (usually) linear combinations of the original variables, with the aim of retaining as much of the relevant information as possible while reducing the complexity of the data.

Factor Loading

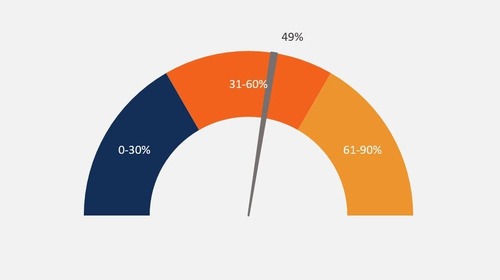

Factor loading is a statistical term commonly used in factor analysis, both exploratory and confirmatory, to quantify the relationship between observed, or manifest, variables.

The resulting values indicate how strongly each observed variable is associated with a particular underlying factor. Higher factor loadings suggest a stronger relationship, while lower values indicate a weaker relationship.

The resulting sign (positive or negative) shows the direction of the relationship, with a positive sign suggesting a positive relationship between the observed variable and the latent factor. A negative sign suggests a negative association.

Factor loadings are typically estimated through techniques such as maximum likelihood estimation. Once determined, factor loadings can help researchers interpret the underlying structure of the data.

Advantages and Disadvantages of Factor Analysis

Advantages

- Dimension Reduction: Factor analysis serves as a powerful tool in simplifying data, making data sets more manageable and interpretable, particularly in the case of data that may have a large number of factors.

- Data Interpretation: Factor analysis helps uncover latent variables, diving deeper into the relationships between observed variables, which can be particularly important in finance.

- Variable Reduction: By paring down redundant or highly correlated variables, factor analysis streamlines the analytical process, reducing both the number of factors and, therefore, computational complexity.

- Hypothesis Testing: Researchers can use factor analysis to thoroughly test hypotheses, helping them to better understand the relationship between variables and predict the ones they observe. This process leads to more informed decision-making.

- Wide Application: Factor analysis can be a useful analytical tool across a spectrum of fields, including finance, psychology, economics, and social sciences, such as multivariate behavioral research.

Disadvantages

- Data Assumptions: Factor analysis is based on certain assumptions, assuming linearity and the stability of relationships between variables. Violations of these assumptions can call the validity of results into question.

- Model Complexity: Performing factor analysis can be tricky because researchers have to make important decisions, such as how many factors to use.

- Interpretation Challenges: The process of deciphering factor solutions can also be challenging, particularly when factors are highly correlated.

- Sensitivity to Data: The results from factor analysis can be impacted by changes in data, so results may vary depending on the specific factor analysis method applied, thus potentially introducing inconsistencies.

Key Takeaways

Factor analysis is a powerful and useful tool in finance and an array of other disciplines. Its ability to simplify complex datasets, identify latent variables, and streamline data interpretation gives it a wide range of applications for researchers and analysts.

When wielded judiciously, factor analysis augments understanding and informs evidence-based decision-making, thereby contributing to the effectiveness of practices across finance and an array of other domains.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in