- What is Private Equity?

- What is Investment Banking?

- Difference Between Investment Banking vs Private Equity

- Investment Banking vs Private Equity Work-Life Balance

- Private Equity vs Investment Banking Compensation

- Private Equity vs Investment Banking – How Do They Make Money?

- Education, Certifications, and Background To Get Into Investment Banking vs Private Equity

Private Equity vs Investment Banking

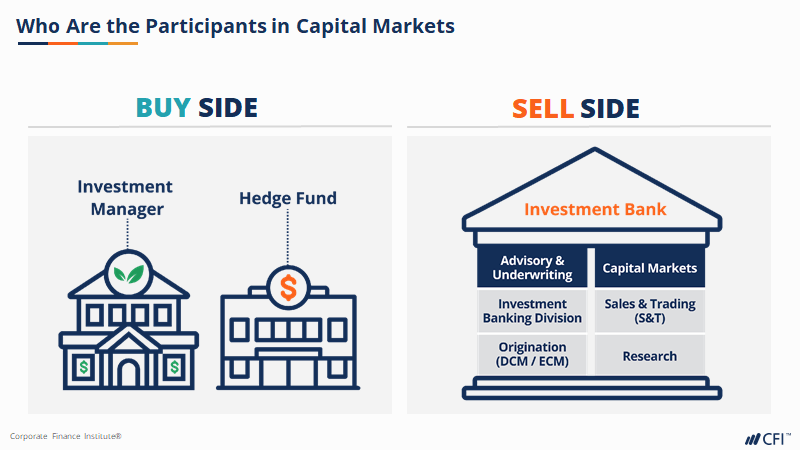

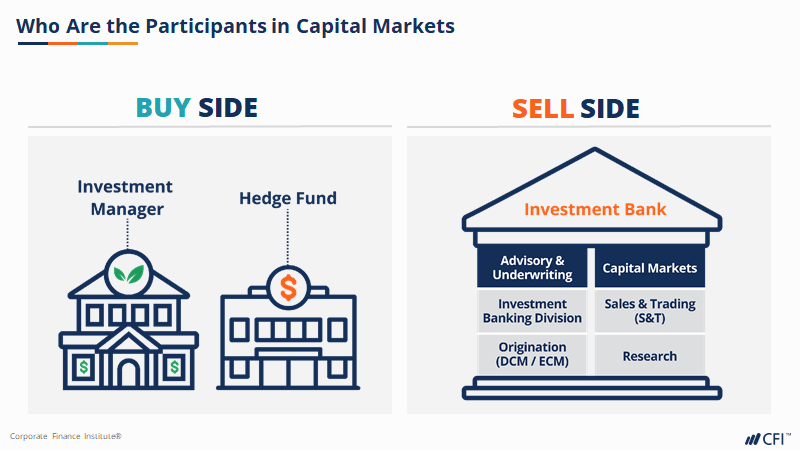

Investment banking and private equity are both industries found within the finance sector. Private equity engages in investment management activities (the buy side), while investment banks are involved in securities intermediation and brokerage (the sell side).

Key Highlights

- Private equity invests in companies, aiming to boost their worth in the long-term. Investment banking provides financial advice, aiding in capital raising and deals for corporations and governments.

- Private equity seeks high returns via long-term, active management. Investment banking focuses on shorter-term transactions, earning fees without direct ownership.

- Private equity pools investor capital for company acquisition and management. Investment banks use their capital for trading, advisory, and underwriting while facilitating client transactions.

What is Private Equity?

Private equity (PE) and venture capital invest in assets that are not publicly traded or listed. Private equity firms can work with investment banks to take publicly traded companies private (i.e., leveraged buyout) and acquire private businesses from venture capital firms and other owners. A private equity firm may also focus on other business interests, for example, as a real estate investor.

Private equity typically requires a controlling interest and employs strategies such as improving operations, restructuring, or making strategic changes. Private equity aims to improve the performance and enhance the enterprise value of potential investments to generate a higher return on investment. The fund performance depends on exit opportunities such as an initial public offering (IPO), or a sale to another PE firm or strategic buyer.

Private equity firms tend to invest in profitable ventures with known cash flow in the mid to late stage of growth. Firms evaluate investment opportunities on a longer horizon than hedge funds, and call on private investors who share similar business interests and investment thesis when deploying the committed capital.

Private equity funds vary widely in size; rather than using their own money, they raise capital from a diverse group of investors, including institutional investors (such as pension funds) to high-net-worth individuals.

Private equity, alongside hedge funds and other buy side roles, are common exit opportunities for an investment banker. More information can be found in our buyout equity career profile.

What is Investment Banking?

Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital raising) and mergers and acquisitions (M&A) advisory services. Investment banks act as intermediaries between investors (who have money to invest) and corporations (who require capital to grow and run their businesses).

An investment bank is a natural sell-side partner to private equity firms on financial transactions, whether by connecting with PE firms looking to invest or by raising capital in capital markets (like debt in the fixed income market).

Bulge bracket investment banks and bulge bracket banks are terms describing large banks that operate globally and are leaders in investment banking, such as JPMorgan, Goldman Sachs and Bank of America Securities (formerly Merrill Lynch). Typical clients are large, multi-national corporations. Investment banks bring the experience and network to successfully execute deals for publicly traded companies looking to raise money.

For more information on investment banking services, careers, and skills of an investment banking analyst, see our investment banking overview.

Difference Between Investment Banking vs Private Equity

Investment banking and private equity are industries that operate within the financial sector, their core functions, objectives, and methods of operation are distinct. To read more on the differences in roles of the industries, see our buy side vs. sell side overview.

Private Equity

1. Investment Strategy

Private equity firms invest in private companies or take public companies private. They raise funds from institutional investors and wealthy individuals to acquire ownership stakes in companies.

2. Ownership and Management

Private equity firms typically acquire a significant ownership stake in the companies they invest in and often take an active role in managing and improving those companies. They may bring in operational expertise, implement strategic changes, and work towards increasing the value of the businesses.

3. Exit Strategy

Private equity firms aim to improve the performance of their portfolio companies over a specific period, typically 3-7 years, before exiting the investments to realize a return. This could involve selling the companies, taking them public through an IPO, or other strategic transactions.

Investment Banking

1. Advisory Services

Investment bankers advise corporations, governments, and other institutions. This includes mergers and acquisitions (M&A), capital raising (such as issuing stocks or bonds), restructuring, and other financial services.

2. Capital Markets

Investment banks facilitate the buying and selling of securities in the capital markets. They underwrite and distribute new securities, trade equities, bonds, and other financial instruments on behalf of clients, or for the banks’ own accounts.

3. Risk Management

Any investment bank may engage in risk management activities, including trading, hedging, and providing risk management solutions to clients to mitigate financial risks.

Investment Banking vs Private Equity Work-Life Balance

The work-life balance at an investment bank and a private equity firm can significantly differ due to the nature of the roles and the demands of each profession:

Investment Banking

1. Long Hours

Investment bankers are notorious for their demanding workload, often requiring long hours, including late nights and weekends, especially during deal closings or busy periods. Investment banking analysts and associates commonly work 80-100 hours per week or more, handling financial modeling, due diligence, and client presentations.

2. High Pressure

The fast-paced environment and high-pressure situations in investment banking can lead to intense work schedules, tight deadlines, and a constant need to meet client demands.

3. Client-Focused

Investment bankers work closely with clients on financial transactions, mergers, acquisitions, and capital raising, which can involve frequent travel and irregular hours based on deal timelines.

Private Equity

1. Work-Life Balance

While private equity can also be demanding, it generally offers a comparatively better work-life balance than investment banking. Private equity associates and other professionals might work long hours during certain phases of deals or while conducting due diligence, but the workload tends to be more predictable and structured.

2. Deal-Driven Schedule

Private equity associates and professionals experience variations in workload based on deal cycles. During the acquisition phase or when actively managing companies, the workload might increase, but it’s often less intense and more predictable compared to investment banking.

3. Focus on Value Creation

Private equity professionals spend time not only on deal sourcing and execution but also on actively managing and adding value to their portfolio, which can result in a more balanced work schedule compared to the deal-focused nature of investment banking.

The differences in work-life balance diminish for senior roles, such as managing director, senior vice president, and other senior management, as most senior roles take on leadership and relationship management and have less direct involvement in deal execution.

Private Equity vs Investment Banking Compensation

Compensation in private equity firms and investment banks can differ based on several factors, like seniority, firm size, location, and performance. Generally, both fields offer high compensation, but they have distinct structures.

Investment banking tends to offer substantial bonuses, particularly for junior analysts and associates, alongside base salaries. These bonuses can often be a significant multiple of the base salary, especially in top-tier firms. As individuals move up the hierarchy to vice president, director, and perhaps managing director roles, the proportion of compensation shifted toward bonuses may change, but the overall compensation remains high.

In private equity, compensation also consists of base salary and bonuses, but the bonus structure can be significantly different. PE firms typically offer carried interest or a share in the profits from investments as a major component of compensation, especially as a private equity associate progresses to a more senior professional. This means that successful deals and investment performance can result in substantial rewards, often surpassing what’s seen in investment banking.

Overall, while investment banking might offer larger upfront bonuses, the potential for higher earnings over time, especially at senior levels, is typically greater in private equity (and venture capital) due to carried interest and profit-sharing arrangements. But both industries are known for offering lucrative compensation packages.

Private Equity vs Investment Banking – How Do They Make Money?

How Do Private Equity Firms Make Money?

Private equity firms make money through a combination of strategies and mechanisms associated with their investments in private companies. Here are some primary ways they generate returns:

Capital Appreciation

Firms aim to buy companies at a certain valuation, improve their operations, growth prospects, and overall value over a period, and then sell them at a higher valuation, generating capital gains. This increase in value is often achieved through operational improvements, cost reductions, revenue growth, and strategic initiatives.

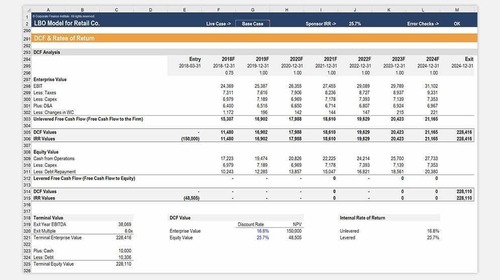

Leverage

PE firms often use leverage or borrowed money to finance a significant portion of the acquisition price of a company. If the company’s value increases, the returns on the equity invested are amplified due to the use of leverage. However, this also increases the risk.

Management Fees and Performance Fees

Firms charge management fees (a percentage of assets under management) to their investors. They also earn performance fees, commonly referred to as carried interest, which is a percentage of the profits generated by the investments. This carried interest is typically around 20% and serves as a substantial source of revenue for the private equity firm once they exceed a certain level of returns for their investors, known as the hurdle rate.

Dividend Distributions

During the holding period of their investments, private equity firms may influence the portfolio companies to distribute dividends, allowing them to recoup a portion of their initial investment while still retaining ownership.

Exit

Private equity investors realize their gains primarily through exit strategies. This includes selling assets through initial public offerings (IPOs), selling to other companies (strategic sales), selling to other private equity firms, or management buyouts.

Successful private equity investments depend on the ability of the firm to identify undervalued companies, implement strategies to enhance their value, and execute profitable exits. The returns generated for investors are a combination of capital appreciation, distributions, and carried interest earned upon successful exits.

How Do Investment Banks Make Money?

Investment banks generate revenue through various streams, including:

Advising

Investment bankers earn fees by advising companies on mergers and acquisitions (M&A), restructuring, and other transactions. This includes providing strategic advice, valuations, and negotiation assistance.

Underwriting

Investment bankers help companies in raising capital through debt or equity offerings (IPOs, secondary offerings, bonds, etc.). They may buy securities from the issuer at a discount (via a bought deal) and then sell them to investors at a higher price, earning the difference (underwriting spread).

Sales and Trading

Investment banks facilitate the buying and selling of financial instruments such as stocks, bonds, derivatives, and commodities for clients. They earn money through commissions, bid-ask spreads, and market-making activities.

Asset Management

Some investment banks have asset management divisions that manage client investments in various financial products, earning fees based on assets under management (AUM).

Research

Investment banks provide research reports and analyses on companies, industries, and market trends. While this may or may not directly generate revenue, it can attract clients to other fee-based services.

Loan Syndication

Investment banks assist in arranging and syndicating loans for corporations and governments, earning fees for this service.

These revenue streams can fluctuate based on market conditions, regulatory changes, and the overall economic environment. Investment banks often have diverse operations that allow them to adapt and generate revenue from different areas of the financial markets.

Education, Certifications, and Background To Get Into Investment Banking vs Private Equity

Investment Banking

- Education: A bachelor’s degree in finance, economics, accounting, or a related field is common but not required. For example, Jerome Powell was an investment banker after working as a lawyer due to his experience with the buy side and sell side of M&A deals. Many aspiring investment bankers pursue further education, such as a Master of Business Administration (MBA), to enhance their credentials.

- Certifications: It is common for an investment banking vice president to hold certifications like the Chartered Financial Analyst (CFA) or Certified Financial Modeling & Valuation Analyst, which add value and demonstrate expertise in finance and investment-related areas.

- Background: Strong analytical skills, financial modeling proficiency, and a deep understanding of financial markets and complex transactions is crucial. Relevant internships, networking, and educational background often help in securing these highly competitive entry-level positions.

Private Equity

- Education: Similar to investment banking, a bachelor’s degree in finance, accounting, economics, or a related field is common. Advanced degrees such as an MBA can also be advantageous.

- Certifications: Certifications like the Chartered Financial Analyst (CFA), Chartered Alternative Investment Analyst (CAIA), and Certified Financial Modeling & Valuation Analyst can be beneficial, showcasing expertise in investment analysis and alternative investments.

- Background: Strong financial analysis skills, experience in financial modeling, and a comprehensive understanding of valuation methodologies are crucial. Relevant experience in investment banking, consulting, or corporate finance is highly sought after for entry into private equity. Networking and building relationships within the industry are also essential.

Internships, networking, and gaining relevant work experience through entry-level positions in finance-related roles (like analyst positions in banks, consulting firms, or corporate finance) can significantly enhance one’s prospects of breaking into investment banking or private equity.

A track record of deal experience, strong quantitative abilities, and a demonstrated passion for finance and investing are highly valued by both industries.

Additional Resources

Thank you for reading this article on the differences between private equity and investment banking. CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst.

To learn more, see these additional relevant resources below:

Investment Banking Interview Questions

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in