- What’s Wrong with Corporate Training in Financial Services?

- A Hiring Manager’s Dream

- Skills Training—The Old Way

- What’s Wrong with a Group/Division-Led Approach?

- Skills Training—The New Way

- Benefits of an Enterprise-Led Approach to Employee Development

- Why is E-Learning the Most Effective Way to Implement this more Robust Approach to L&D?

- The Bottom Line

- Related Resources

Financial Services Training—Reimagined

What’s Wrong with Corporate Training in Financial Services?

It’s tempting to throw out an eye-catching headline like: training in financial services is broken! (But I’m not a click-bait kind of guy…)

Training isn’t broken—but it could certainly use a rethinking.

Interest in our CFI for Teams offering has exploded lately, and I have the privilege of engaging with a growing number of clients and prospects accordingly. We’re seeing a lot of different flavors of learning and development programs, as well as possible use cases for our content library—which is super exciting.

But training is often used as a catch-all term that conflates a bunch of important (but distinctly different) parts of an employee’s learning and development journey. These include formal learning/skills training, mentorship, on-the-job development, and compliance-related licensing requirements.

Perhaps more importantly, it seems that conventional wisdom at many organizations is still that responsibility for getting an employee “role ready” rests with the team or division at which that employee is eventually expected to contribute.

To me, this perspective is a classic example of missing the forest for the trees.

Key Highlights

- Issues with traditional-looking training include that it’s episodic, overly-scheduled, and reactive.

- Learning is a process, not an event; skills training should reflect that.

- The best learning and development programs look at an employee’s lifecycle across the entire organization (not just their current role).

- A robust library of e-learning resources allows employees to access learning in parallel with on-the-job responsibilities, and at a time the material is most relevant to them.

A Hiring Manager’s Dream

The learning and development process, really, can be best characterized as an employee’s journey towards aptitude.

When you ask people managers how long that journey should take, the typical answer is—it depends. And they’re partly right; factors like the employee’s level of education, as well as their role and institution-specific experience do matter.

But I would argue one of the most critical factors that’s often overlooked is actually when (and where) the journey begins!

Imagine a world where people that are newly appointed to a position with the firm are basically role-ready and capable of adding value in short order (if not immediately)?

It’s not that far-fetched; conventional wisdom has just approached employee development in a far-too-modular fashion. What if financial services firms started people on their journeys to aptitude sooner? What if they began that journey well ahead of actually beginning a new role?

Skills Training—The Old Way

Some of the hallmarks of “old training” are:

- It’s episodic. That means it starts and ends at clearly defined boundaries. This implies, once an employee receives a particular credential (or ticks some other box), that learning is complete. Even though we know, intuitively, that learning is a process (not an event).

- It’s (highly) scheduled. This is particularly true of traditional instructor-led training, where the participant is told to arrive at X time and to wrap up at Y, even if:

- That’s not a convenient or optimal time for them to digest this information; maybe they have a sick dependent at home or they have client requests coming in.

- It’s too long (or too short) to really make sense of the content being delivered. Or,

- The content being taught isn’t relevant to them at this stage of their journey. Consider that classroom training happens in groups and, unless it’s a cohort-based model (like all interns arriving in May), the participants all have different starting dates in the role.

- It’s reactive. A person is hired for a role on the ABC team, so it’s now time to get them up to speed on the technical skills required to be successful on the ABC team. A big, underrated issue here is that the individual is usually least motivated to learn the skills required once they’ve already been appointed; they just want to hit the ground and start contributing! And this is largely because:

- Old training is team or division-led…

What’s Wrong with a Group/Division-Led Approach?

Think about it… The onboarding and upskilling plan for retail bankers is overseen by leadership within the retail banking group. Business and commercial by leadership within that group; ditto wealth management, and so on.

This segmentation strategy appears logical, on paper. Particularly if you believe the following to be true (which many people do):

- Training for a particular team or division requires highly specialized skills and knowledge that can only be delivered by folks on that team or in that division.

- That once someone is hired on a team or into a division, the fastest way to competency and contribution is via tailored skills training delivered and overseen by that team/group.

- (Perhaps most importantly) the team or division in question owns and is responsible for its own P&L… This is a big one.

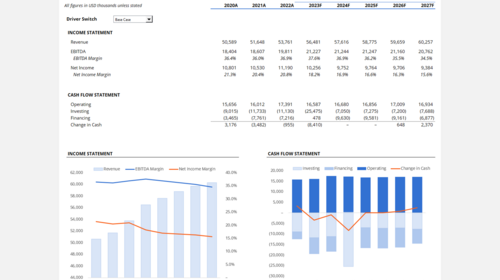

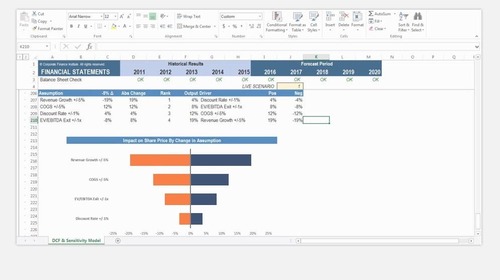

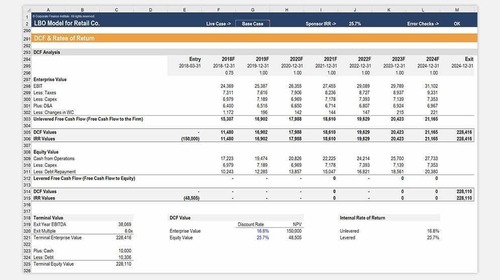

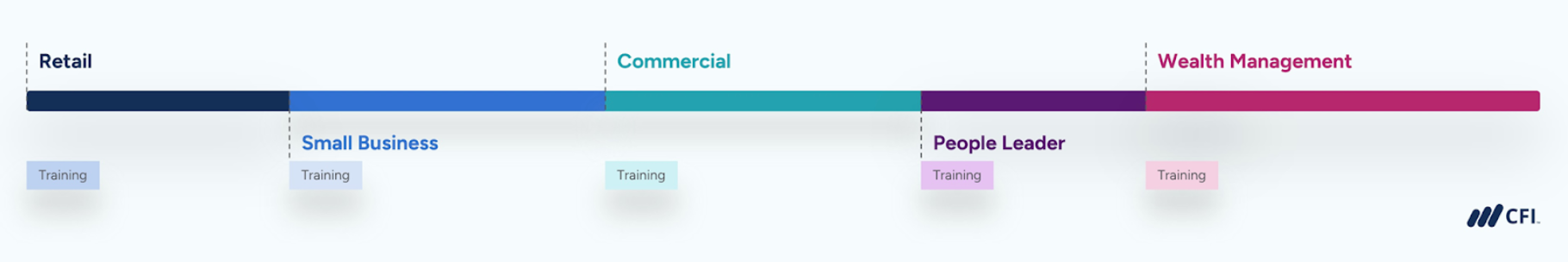

The following timeline/diagram illustrates a completely normal looking career progression for many folks that work at a bank or a credit union.

They spend some time in retail then maybe move into business banking. Perhaps they excel there and transition over to larger clients in commercial. Maybe then they do a stint as a people manager before ultimately deciding to move into wealth management in the back nine of their career.

Note how the “old” training paradigm is very compartmentalized by division; start the role, commence training for the role, rinse and repeat at the next transition.

Skills Training—The New Way

A more modern and, frankly, comprehensive approach to training and development requires a paradigm shift. The characteristics of a more modern-looking training model include:

- It’s ongoing. As you’ll see in the diagram below, there’s formal training and/or learning going on throughout the employee’s lifecycle with the organization

- It’s performance-adjacent. This is more than a ‘buzzword;’ people learn as they do their job, that’s just reality. They’ll see problems with a deal, a trade, or a client file and they’ll actively seek out information in real time to support them in navigating those discussions. This is where scheduled, instructor-led training (often delivered too early in someone’s tenure) really falls short.

- It’s proactive. With the exception of the first job (in retail, in this example), you’ll note in the diagram below that training for the next role begins while the employee is still in their previous position. This turns training from a stick into a carrot, and allows staff to add value much more quickly when they transition into that next role. And,

- Of course this can’t be executed without a holistic, enterprise-led approach.

Benefits of an Enterprise-Led Approach to Employee Development

If a team or a division is responsible for its own training and budget, the natural instinct is to optimize perceived ROI. So if they have to spend a lot on training, they’ll look to retain the employee on the team for as long as is practical, and extract as much value from them during that tenure. Sadly, some managers actively seek to slow peoples’ career progression in order to keep them around as long as possible in their current role.

This is very short term thinking. It’s considering only the employee’s lifecycle in role, as opposed to their lifecycle with the firm (which could include many roles across many divisions). This type of lens allows us to think about mobility within an organization differently, as well as how we might want to allocate human and financial resources toward learning and development.

Here are a handful of reasons why thinking about learning and development at the enterprise level makes tons of sense:

It Makes Training More Exciting

I think back to when I started in commercial banking. Once I was hired, all I wanted to do was get out, pound the pavement for new business, and start generating value for the firm (and for my bonus). The last thing I wanted to do was spend time training.

By adopting a lifecycle model towards learning and development, an organization can have candidates training before they ever transition into their new role. Employees will be excited to train for their next move, because they’re inherently hungrier at that point of their career than they are after signing the new contract. It’s the carrot vs. stick approach!

It Allows People to be Performant (or to Excel) More Quickly

If someone is coming into their new role with a foundational understanding of the technical skills required, they’ll immediately get more out of any mentorship programs the organization has in place and any exposure to client files that they’re getting. They’ll also feel more ready and more confident to deliver value quickly.

It Fosters a (Genuine) Culture of Learning

This is one tangible step that senior leaders can take towards fostering a culture of learning (rather than just talking about it).

If future promotions and other internal moves are contingent upon executing a learning plan with your current manager, and actually starting (or substantially completing) role-based technical skills training prior to promotion, then you better believe more learning will be going on in that organization.

It Improves Retention

Executed effectively, this should work at both the role-level and at the enterprise level.

From a role perspective: If an employee is set up to succeed in their next role more quickly, they probably will. By training on the technical skills 1-2 quarters ahead of transition they should hit the ground running (or at least walking) and feel more confident more quickly.

Contrast that with the old model, where they get hired, (typically) take on some portfolio responsibilities while trying to complete classroom training and somehow appreciate whatever mentorship process is in place, and you can see why people get overwhelmed and frustrated early in many roles. It’s like drinking from a fire hose, which causes people to churn out more quickly.

From an organizational perspective: Happy employees that can see (and achieve) a clear path towards career progression internally are more likely to progress internally.

If they’re regularly working with their manager on how to prepare for what’s next, and if that manager is legitimately supporting them on that journey, that employee is less likely to look outside the organization for their next promotion.

It Creates a Unique Competitive Advantage

The nature of managing human capital has changed considerably over the last 5-10 years. Most people don’t jump into a role and stay there for the balance of their career. And the reality is you can’t force them to stay.

Either senior leaders support mobility (internally) or employees will go get it elsewhere—and turnover can also be very expensive.

Role turnover can become a headache if it’s not managed effectively. But if “mobility” is woven into the fabric of an organization (then brought to life via a legitimate culture of learning and development), this can become a tool for attracting and retaining top talent.

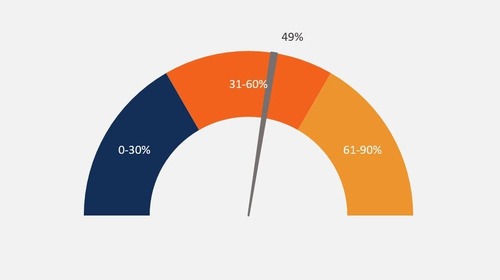

Consider the following statistics from a 2023 training and development report conducted by Zippia:

- 45% of workers would stay at a company longer if it invested in their learning and development.

- 92% of employees say employee training programs have a positive effect on their engagement (when well-planned).

- Companies with comprehensive training programs have profit margins, on average, as much as 24% higher than their peer groups.

Why is E-Learning the Most Effective Way to Implement this more Robust Approach to L&D?

Traditional, asynchronous training like classroom and other (virtual) instructor-led models, lend themselves really well to a more traditional looking training program, which tends to be delivered reactively and in a modular fashion.

E-learning resources, on the other hand, are available asynchronously – which means:

- Any time. Including 1-2 quarters ahead of an employee’s next move.

- When it’s convenient. Meaning when a learner can be most focused on the content (maybe early morning or late at night, when the kids are asleep and clients aren’t calling).

- When it’s most relevant to them. Staff in a dynamic environment (like financial services) come upon new challenges and opportunities all the time; having access to best-in-class resources that can be consumed in parallel with their day-to-day duties means that employees can learn something at the precise moment that they’re most likely to need (and retain) it.

- It’s WAY more cost effective. Classroom training is expensive, both in terms of cash costs but also the opportunity cost of having people “away from their desks.” An E-learning library like CFI’s is very robust and much less expensive to deliver.

The Bottom Line

An employee’s journey to aptitude takes time, so starting it sooner seems like a no-brainer. So too does making a library of resources available to each employee so they’re able to learn in real time as real issues come up in their daily duties.

When senior leaders at financial services firms are able to step back and think about formal skills training with an enterprise-level perspective, it opens the door for more innovative delivery strategies and better outcomes—both for individual employees and the firm more broadly.

Related Resources

The following resources may also be helpful:

Improving Higher Ed with Online Learning Platforms

Why Online Training for Finance Teams Makes Sense

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in