- What is Supply Side Economics?

- How Does Supply Create Demand?

- The Three Pillars of Supply Side Theory

- How Does an Economy Increase Aggregate Supply?

- Aggregate Demand and Supply

- Equilibrium and the Supply Side Argument

- How Do Supply Side Policies Help Control Inflation?

- How is Supply Side Economics Different from Demand Side Economics?

- The History of Supply Side Economic Theory

- What has Ronald Reagan Got to Do with Supply Side Economics?

Supply Side Economics

"Economic growth can be achieved by increasing the total, or aggregate, supply of goods and services within an economy"

What is Supply Side Economics?

Supply side economics is an economic theory that states that economic growth can be achieved by increasing the total, or aggregate, supply of goods and services within an economy. This is achieved by reducing economic barriers for producers to supply excess goods and services at lower prices, which will stimulate demand. The most commonly cited method of reducing these barriers is via cuts to marginal tax rates.

Key Highlights

- Supply side economics is a field of economic research that believes in reducing economic barriers to production in order to supply excess goods and services, which will, in turn, stimulate demand.

- “Supply-siders” believe that a tax cut to marginal tax rates, smaller governments with less regulatory overhang, and interference from monetary policy would lead to a stronger economy and, ultimately, higher tax revenue gains.

- Supply side economics has been around for a long time but was popularized by President Reagan in the 1980s when he campaigned on a platform to cut taxes and to implement supply side policies.

How Does Supply Create Demand?

The basic idea of supply side economic theory is that the way to grow an economy lies not in the demand from all groups within that economy but rather is based on the amount of goods and services supplied. In the long run, supply-siders believe that any economic barrier to supply discourages workers (called labor inputs) and companies from working harder and reduces the productivity of an economy as a whole.

On the other hand, if an economy has low barriers imposed on its workers and companies, these same workers and companies will produce more goods and services. The excess goods and services produced drive down prices, which leads consumers to buy more and absorb the excess supply. Supply side economists argue that this increased production supply is what creates meaningful and sustainable growth in an economy in the long run.

The Three Pillars of Supply Side Theory

What exactly are the barriers that supply-siders are most concerned about? Supply side economic policy postulates that there are three pillars that influence aggregate supply, thereby impacting economic growth.

1. Tax Policy

The main pillar of supply side economic policy is the amount of taxes charged on individuals and companies. By altering tax rates, governments incentivize its citizens to work and invest.

Supply-siders believe that by lowering the marginal income tax rate, individuals are enticed to work harder, and companies are motivated to produce more goods and services. Income tax cuts in the form of lower capital gains taxes would motivate more investment. Lower taxes would also lead to more corporate profits, helping to boost stock and asset prices, which in turn help raise consumption.

On the other hand, an increase in marginal tax rates makes individuals less inclined to work and instead may shift to more leisure activities. Instead of using resources in the most effective manner, higher marginal tax rates might lead companies to pursue strategies solely to reduce the amount of taxes they pay, reducing overall productivity growth.

Since less real economic activity is taking place, a high tax rate might actually lead to lower overall tax revenues for the government as the tax base has effectively shrunk.

2. Regulatory Policy

The second pillar behind supply side economics is the role of regulatory policy. Supply side economics argued that government intervention hinders companies and individuals from producing goods and services. Intervention, they believe, can take the form of government regulations, quotas, and subsidies.

Some supply side theorists also feel that intervention in the form of government policies like unemployment insurance, welfare and other entitlements, even minimum wage, distort the effective labor supply.

They assert that free markets are the most efficient way to allocate resources. As such, supply side economists argued for smaller governments since they felt that governments are monopolists, inefficient as they are not “profit-maximizing,” and lack market discipline. Even with true public (such as defense) and merit (such as assistance for the needy) goods, pure supply side economics posit that large, bureaucratic, and inefficient governments are not the lowest-cost providers of these services.

3. Monetary Policy

Supply side economics also believes the monetary policies of central banks, like the United States Federal Reserve Bank, to control the money supply to control inflation, aggregate demand, and employment is ineffective.

When central banks are easing monetary policy in hopes of growing the economy, supply-siders worry that this creates unnecessary inflation. On the other hand, supply side economists bemoan tight monetary policy as it removes much-needed liquidity from the market.

Certainly, this is one of the most controversial tenets of supply side economics.

How Does an Economy Increase Aggregate Supply?

In order to answer this question, we will review a simple economic education of aggregate demand and supply.

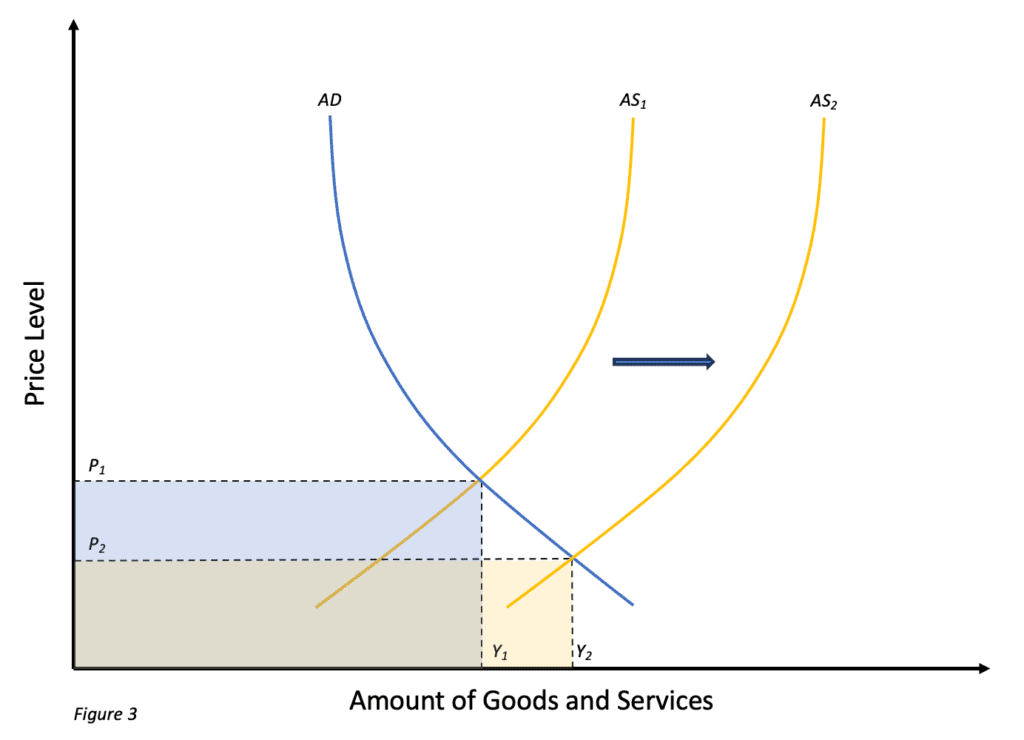

Aggregate Demand and Supply

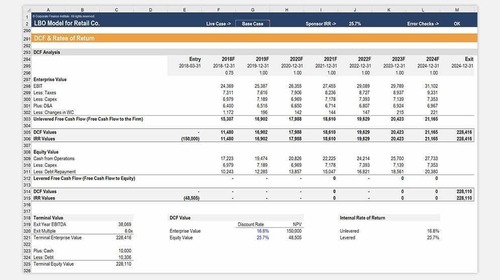

In macroeconomics theory, aggregate demand is an inverse relationship between the level of prices in an economy and the quantity of goods and services that households, businesses, governments, and foreigners are willing to purchase from that economy. Graphically, the relationship would look like Figure 1 below.

Let’s assume that if we are at price P1, the combined demand of households, businesses, governments, and foreigners is at point Y1. If prices go up to P2, rationally, you would expect that same combined demand to fall to Y2. Conversely, if prices go lower to P3, combined demand should go up to Y3. Graphing all the points, we may come up with an aggregate demand (“AD”) curve, which looks like the blue line we have above.

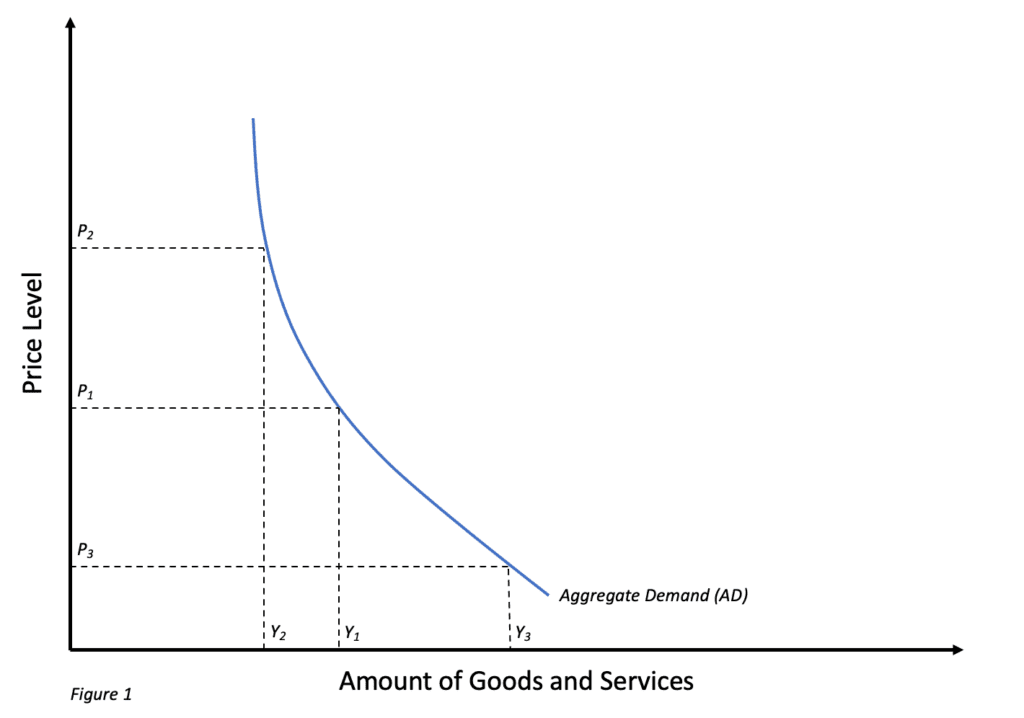

Aggregate supply, on the other hand, is the relationship between the level of prices in an economy and the quantity of goods and services that the labor force and companies are willing to produce. This is represented in Figure 2 below.

Again, we start at price level P1 when the combined supply of goods and services is at Y1. If prices go higher, say to P2, the amount that producers would be willing to supply would go up to Y2. Oppositely, if prices fall, say, to level P3, the amounts that would be produced are expected to fall to a level lower, like Y3.

Equilibrium and the Supply Side Argument

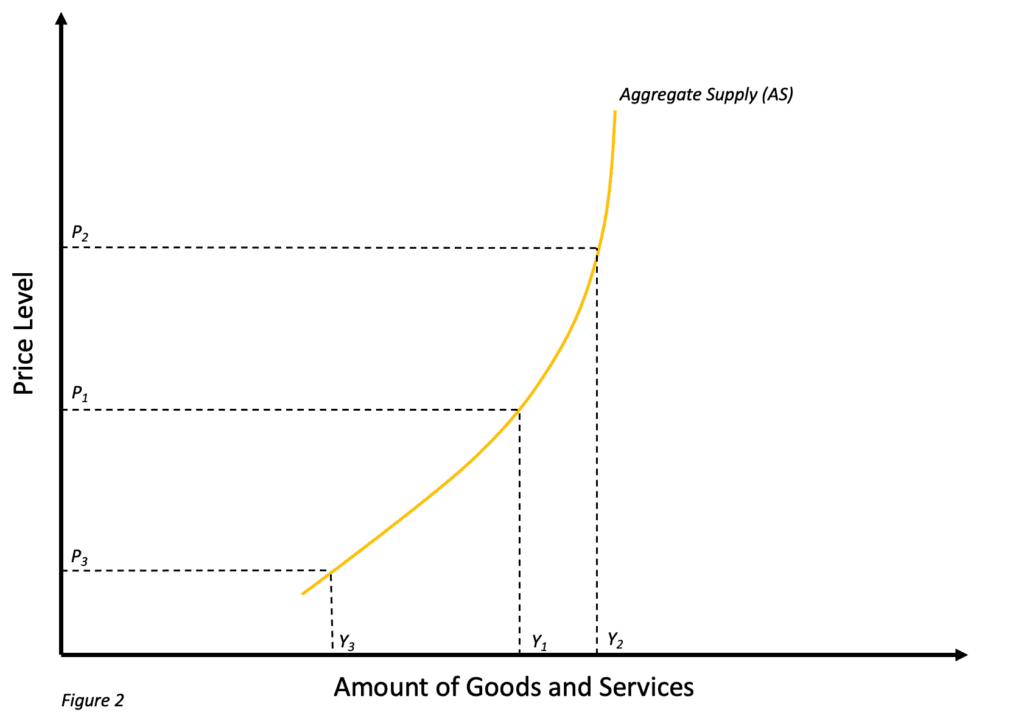

In traditional macroeconomics, it is believed that an economy will find an equilibrium where aggregate demand and aggregate supply meet, as we see in Figure 3 below, where the blue AD curve and the yellow AS1 curve intersect.

Traditional economics also argues that IF supply were to increase, like we see when the curve AS1 shifts to the right to AS2, the equilibrium also shifts to the right to where AD and AS2 now intersect. However, the key is that the area in the blue and yellow boxes in Figure 3 is the same size, indicating no real change in the size of the economy.

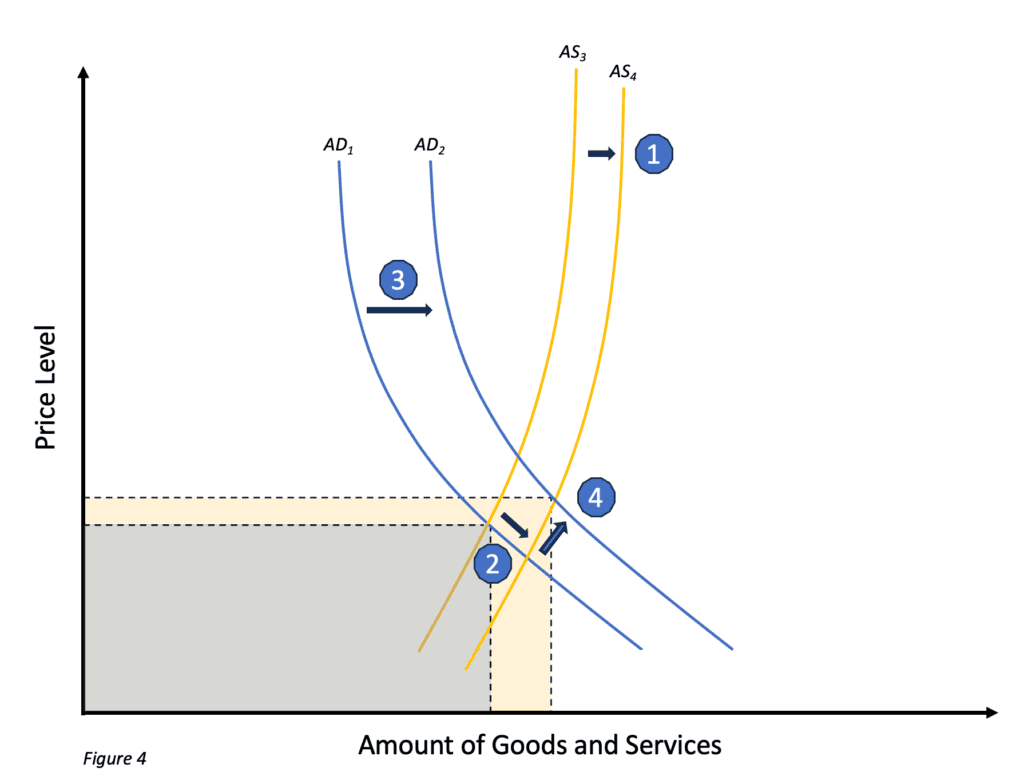

Supply side economics, however, argues that the aggregate supply curve is nearly vertical, as we see below in Figure 4 in curve AS3. Supply-siders argue that if barriers (such as a cut in marginal tax rates) are removed, producers would be more inclined to produce more, shifting the near-vertical aggregate supply curve over to the right (step 1). The new aggregate supply curve, AS4, would create lower prices, as we see in step 2.

As the higher incomes and profits plus the tax cuts benefit all consumers, aggregate demand also increases, shifting the aggregate demand curve from AD1 to AD2, as we see in step 3.

Ultimately, this leads to an expansion of the entire economy (from the blue rectangle to the yellow rectangle) in contrast to Figure 3 to point 4 and a higher aggregate demand and supply equilibrium.

How Do Supply Side Policies Help Control Inflation?

Another potential advantage to supply side economics is that, in theory, it is not inflationary. In demand-driven economic theory, the aim is to put more money into the system and increase the demand of consumers, both inflationary measures.

However, supply side economics holds the belief in tax reductions, increasing the supply of goods and services, and less monetary policy interference in the economy. All three of these policies tend to be deflationary, which helps to control inflation.

How is Supply Side Economics Different from Demand Side Economics?

Traditional Keynesian economics believes in the use of government spending and taxation in order to influence the economy by targeting aggregate demand – called fiscal policies.

Additionally, according to the International Monetary Fund (IMF), central banks indirectly target demand by controlling the money supply through adjustments to interest rates, bank reserve requirements, and the purchase and sale of government securities and foreign exchange – called monetary policy.

This combination of fiscal and monetary policy is aimed at impacting the aggregate demand of individual and corporate consumers to change the overall output and employment in an economy. In other words, put money in the pockets of consumers and they will spend.

Supply siders, however, believe that the willingness of producers to create goods and services is what drives economic growth, going so far as to suggest that aggregate demand in an economy is largely irrelevant. They propose that producers, rather than consumers, should be considered the driving force in the economy and their economic behavior is the most important driver of economic activity.

Hence, supply side policies that focus on income tax cuts, deregulation and allowing the free market to work are the keys to driving economic growth. So to simplify, supply side economic theory suggests producing more goods and services, driving down prices to entice more consumption.

The History of Supply Side Economic Theory

Supply side policies are often described as a return to classical economic ideas such as maximizing capacity and removing government impediments from nineteenth-century economic theories like Adam Smith’s Wealth of Nations. Some even believe that supply side theory dates as far back as 14th-century Arabia, to the scholar Ibn Khaldun.

However, during the depression years of the 1930s, Keynesian economics took the forefront, but by the 1970s, the stagflation of that era led many economists, such as Jude Wanniski, Robert Mundell, and Arthur Laffer, to revisit supply side economic policies.

In 1978, Wanniski published The Way the World Works lamenting the failure of high tax rates and US monetary policy under Presidents Richard Nixon and Jimmy Carter. In his book, Wanniski advocated for lower income tax rates and a return to the gold standard abandoned by President Nixon.

The Laffer Curve

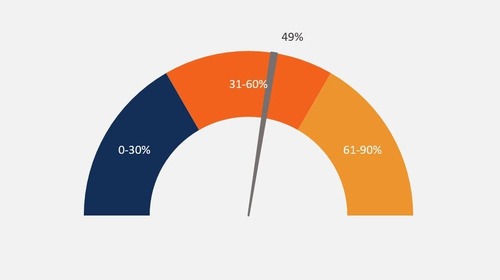

Economist Arthur Laffer, with his eponymous curve in 1974, illustrates the theoretical underpinning of supply side economics. His economic research postulated that the effect of $1 of tax cuts reduces spending by the government by the sum of exactly one dollar. However, that same tax cut has a multiplier effect on economic growth so every dollar in tax cuts translates into increased demand, which stimulates business growth and, in turn, results in additional hiring – ultimately leading to more tax revenue by expanding the tax base.

As a result, Laffer believed that there could be two different tax rates that could achieve the same tax revenue. We show this below in Figure 5.

What has Ronald Reagan Got to Do with Supply Side Economics?

Supply side policies are often synonymous with “Reaganomics,” a portmanteau of Ronald Reagan and Economics. During his two terms in office in the 1980s, President Reagan promoted his version of supply side economics. His policies included balancing the federal budget, slowing government spending, reducing tax rates and government regulation, and finally tightening the money supply to reduce inflation.

In 1981, for example, Reagan relaxed price controls, lowered the top marginal tax rate from 70% to 50%, and enacted tax cuts for corporations. In 1986, Reagan sought to simplify the tax code by eliminating many deductions while still managing to increase tax revenue, despite further reducing the highest marginal tax rates to only 28%, as well as reducing the number of tax brackets for US taxpayers.

With all the tax cuts and reduction of regulatory barriers, real GDP grew by over $2 trillion during Reagan’s presidency. According to the St. Louis Fed, the compounded annual growth rate of US GDP was 3.6%, compared with 2.7% during President Jimmy Carter’s years in office. Government revenue increased from $599 billion in 1981 to $991 billion in 1989 – an increase of over 65%.

“Trickle Down Economics”

However, the era of Reaganomics wasn’t without its critics. Many opponents of Reagan’s supply side economic policies felt that the benefits were accruing to the wealthy, who enjoyed the largest cuts to their marginal tax rates. Additional policies, such as the reduction of estate taxes, were also seen by supply side critics as an example of helping the rich stay rich (and perhaps get even richer).

As a result, supply side economics also gained the moniker of “Trickle Down Economics,” implying that the poor could only benefit if the tax rate cuts given to the rich would finally trickle down to them. It also implied that any extra income the poor might receive would be meager compared to the additional income the rich would gain.

Unfortunately, the Reagan era also brought larger budget deficits, leading to an increase in US federal debt – almost three-fold from $738 billion to over $2.1 trillion – due to large increases in military spending.

Learn More

Thank you for reading CFI’s guide to What is Supply Side Economics. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in